A LONG STANDING HOUSING CRISIS

An examination of Hawaii’s newspaper archives shows that Hawaii has been facing one housing crisis after another for generations. Despite waves of government reform, the problem seems to only get worse.

Politicians have been pledging to address a shortage of housing in the islands for decades, but the root causes of the crisis run deep.

They were going to solve Hawaii’s housing crisis in five months. It was 1970, and the housing situation in Hawaii had gone from bad to worse. Inflation had pushed the interest rate on mortgages to 7.5% the previous year, causing a slowdown in construction. Few houses were on the market. The vacancy rate for existing housing was minuscule. People were struggling.

“Every day lost in arriving at the needed solutions is going to mean a direct drain on the human resources Hawaii loses, or is unable to attract, and a further clamp on the economy,” the Hawaii Tribune-Herald wrote in an editorial.

Bold action was the only way forward, and politicians had — well, they didn’t have a plan. But they had an idea that could lead to a plan. Just give them half a year and the public would see results.

In the early 1970s Hawaii saw a flurry of government activity aimed at alleviating the lack of affordable housing for low-income families and increasing the generally limited housing stock in the state overall. Politicians called for investigations, passed new laws and pledged to make lasting reforms.

Half a century later, with interest rates back up above 7%, the average single-family home on Oahu selling for over $1 million and nearly 40% of residents in the state saddled with “high burden” housing costs, it’s easy to see that any solutions found in the early 1970s didn’t solve the problem for long.

The lack of available housing in 2023 is an “existential” crisis for the state, Gov. Josh Green said earlier this year, declaring a state of emergency to try to speed up new housing construction.

The roots of Hawaii’s housing crisis runs deep

The state has “the most restrictive land-use regulations in the country.” Only 4% of land in the state is zoned for residential housing. Multifamily homes are only allowed on 0.3% of land in the state.

Hawaii has the lowest property taxes in the nation, which makes the state enticing to property investors who can often outbid local families. Vacation rentals take up between 2% and 15% of the housing stock, depending on the island.

A century after the Great Mahele — a historic land division in the 19th century that created a private property ownership system for the first time ever in Hawaii — 58.4% of private land on Oahu was controlled by three major landowners.

Despite the complexity of the problem, politicians and reporters have often focused their attention on the need to reduce construction costs.

“You can’t reduce the price of your land, so you must reduce the construction costs of your housing units,” a real estate consultant told the Honolulu Star-Advertiser in 1968.

Perhaps the answer could be found in designing easier-to-build homes, lawmakers have suggested repeatedly over the decades. Or maybe the key could be reviewing zoning regulations. Creating incentives to subsidize the construction of affordable homes. Or “slimming down the government’s permitting bureaucracy”.

The words “housing” and “crisis” appeared in Hawaii newspapers 2,917 times between 1936 and 2023. Some of those mentions are from national and international stories. But many are about the struggles here.

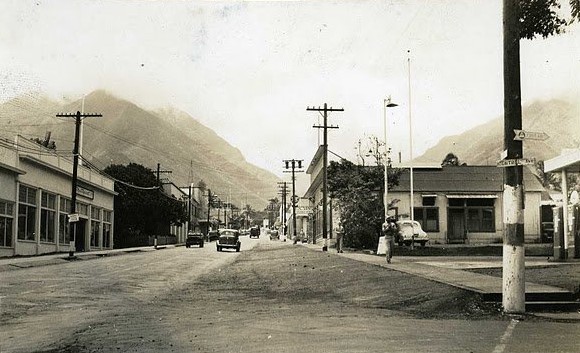

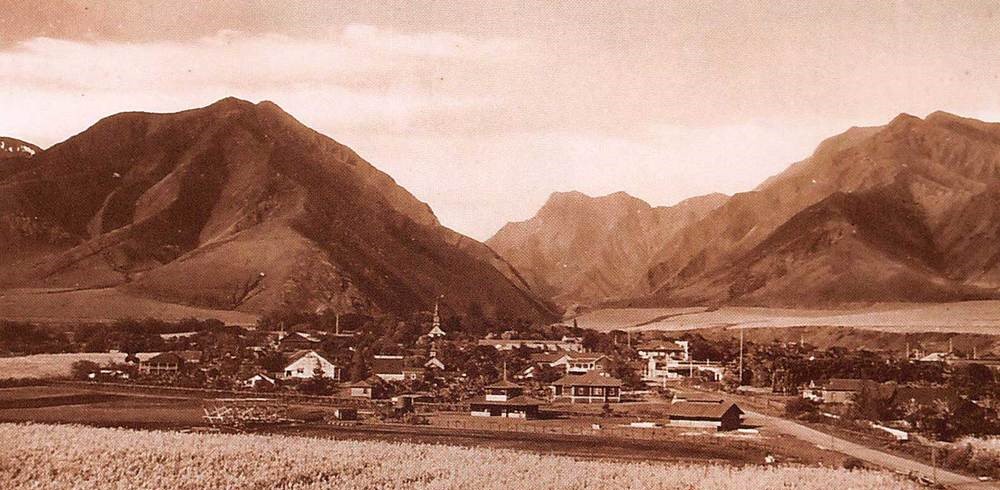

There was a “housing crisis” in Honolulu in the 1930s caused by the transfer of U.S. Navy personnel and their families to the island. Another in the 1940s during World War II.

In 1955, Honolulu’s deteriorating housing stock was a “creeping cancer” that endangered the city, said the head of Honolulu’s Urban Redevelopment Agency.

By the late 1960s, newspapers were declaring housing to be one of the top challenges facing the islands. A sentiment echoed over and over again in papers in the 1970s, 1990s, and today.

Building Our Way Out Of This

During the housing crisis of the late 1960s and early 1970s, many commenters seemed optimistic that government action might indeed bring about real change.

Gov. John A. Burns put together a housing committee to study the problem and set a five-month deadline for recommendations.

The group would look at prefab housing, he said. At how to reduce financing costs. There would be a “serious review” of zoning laws to see how regulations impacted the cost of housing.

And it would have a special event in the spring of 1970 showcasing low-cost model homes to the public — a priority, the governor’s urban affairs assistant said, so that the public would see “proof that the State is getting somewhere on the problem.

The state convened a housing summit that brought together builders, banks, politicians, bureaucrats and union organizers. The multiday gathering ended with few specific solutions identified, but “a note of optimism that Hawaii will build its way out of the housing crisis” the Honolulu Star-Bulletin wrote in 1970.

The Legislature did take a number of actions that year to try to address the state’s housing woes, including the passage of an omnibus bill that gave the Hawaii Housing Authority the ability to form partnerships with private companies to construct housing for families that made too much money for public housing but still couldn’t afford a regular mortgage.

Act 105 also authorized millions in bond sales for housing projects and created a program to provide down payment loans at low-interest rates or a 100% loan in certain circumstances to families.

Enthusiasm for the efforts didn’t last long.

Then-Lt. Gov. Thomas P. Gill — who had recently run a failed campaign for governor — was intensely critical of the efforts, saying the proposals in Act 105 were “developer-oriented.” He pushed for a much more significant set of state reforms to address the issue.

Gill wanted Hawaii to use state-owned land and “land acquired through condemnation, purchase or exchange” to build housing. He also wanted the state to try to acquire federal land for the efforts.

Additionally, he wanted the state to contract directly with developers to build 5,000 to 10,000 units a year and insisted that any effort to make a housing program work would have to “bypass parts of the existing industry structure.”

“The reason for this is simple,” he said in a Honolulu Star-Bulletin story in December of that year. “The industry is geared toward charging all that the traffic can bear.”

Although Gill’s bid for the governor’s office was unsuccessful, by 1973, stories were coming out about failed projects launched under Act 105, and lawmakers were calling for the creation of a new state “housing czar” position to cut through red tape and address construction delays on state projects.

By 1976, lawmakers were demanding an audit of the act. Though Act 105 was referred to decades later by lawmakers as an important step in addressing housing issues, the warnings of Gill have also resurfaced in recent years as the state has continued to debate how to best address our housing woes.

By 1990, more than a third of respondents in a newspaper poll wanted to see immigration to the islands cease until housing issues could be addressed, while over half of people polled said they didn’t believe the housing crisis could ever be solved.

And how the woes have continued. People who worried about 7.5% interest in the early 1970s saw interest rates rise to more than 18% a decade later.

At the time of Gill’s push for housing reforms, newspaper reports said that a good “rule-of-thumb” for families was for rental or housing payments to take up about 20% of their household income — a percentage that would likely be considered shockingly low to most Hawaii families today.

As of 2019, renters in nearly half the census tracts in the state were spending an average of 30% to 49% of their income on rent.

And while homeownership rates in Hawaii have increased in the last two decades, the state still has one of the lowest percentages of people living in their own homes in the nation.

Source: Honolulu Civic Beat